Title Slide

Debt creates financial and moral complications for all individuals, but it affects some people differently depending on their circumstances. Let’s start with an every day, but an unpleasant event, you need to go to the hospital unexpectedly and accrue medical bills putting you in debt.

Then you find out your car needs a major repair, so you expense it to a credit card, further growing your debt.

Now, you’ve lost your job. Some of you have you have means to absorb these financial setbacks, but for people who were already struggling to make ends meet these shocks mean that they need to take on more debt...

... continuing down the debt spiral further and further. Making it more and more difficult to decide what expenses need to be prioritized.

Debt is a huge issue. In New York City alone, 5.6 million people have over 27 billion dollars in debt*.

It’s no wonder why the debt collection industry has grown from 5 licensed debt collection agencies in 1992 to...

8500 agencies today**. Why? It not just that there is a potential $27 billion on the table, it’s that the profit margins for debt collectors are astronomical.

Here’s an example from a New York Times article**. Agencies can obtain debt in bulk very cheaply, and collect more money than what they purchase it for.

The industry is able to take advantage of consumers with debt, because everything about it, from how the industry works, to terminology, to individual rights are complicated and confusing for the consumer. They use aggressive harassment tactics to maximize their profits collecting money that they may not have the legal right to collect.

Jaqlyn is one person who was taken advantage of. We met her at a legal clinic in New York City.

She had over $11,000 in debt and collectors were calling her multiple times a day every day trying to get money from her that she didn’t have. She is retired and her only sources of income are from Social Security and a small pension.

We were able to help Jaqlyn assert her rights against the debt collection agencies through a web application we developed that guides people through writing a letter to debt collection agencies and mailing it without having to go to the post office.

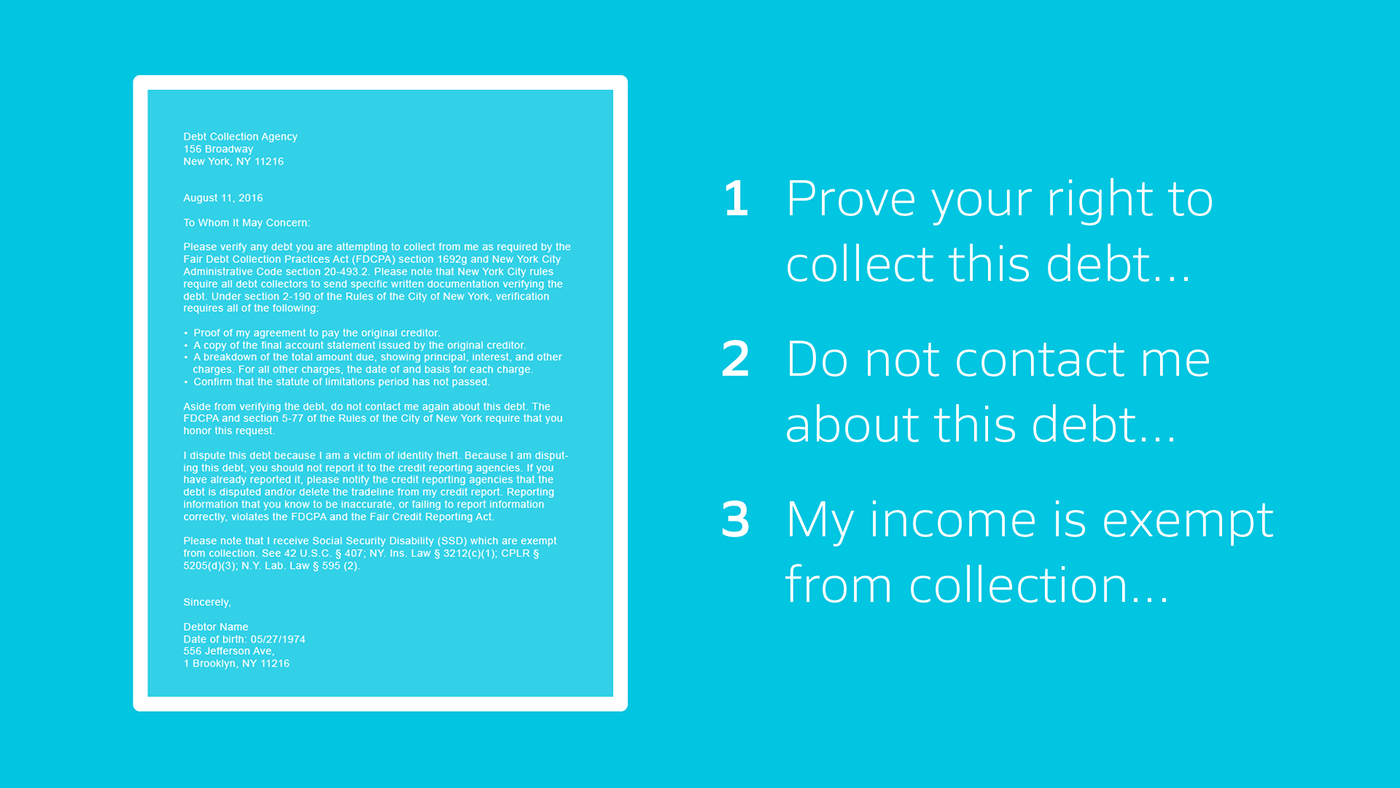

This letter does three things; 1) It makes the debt collection agency prove that they have the right to collect money. A lot of the time collectors don’t have all of the information they need to legally collect the debt. 2) It tells the agency that they can’t harass the sender anymore. There are strict laws regarding harassment that collectors need to follow. 3) It tells the agency the sender’s income can’t be collected if it is exempt from collection. Jaqlyn’s only sources of income can’t be collected by law

50% of the time the debt collection agency will stop collection efforts upon the receipt of these letters†.

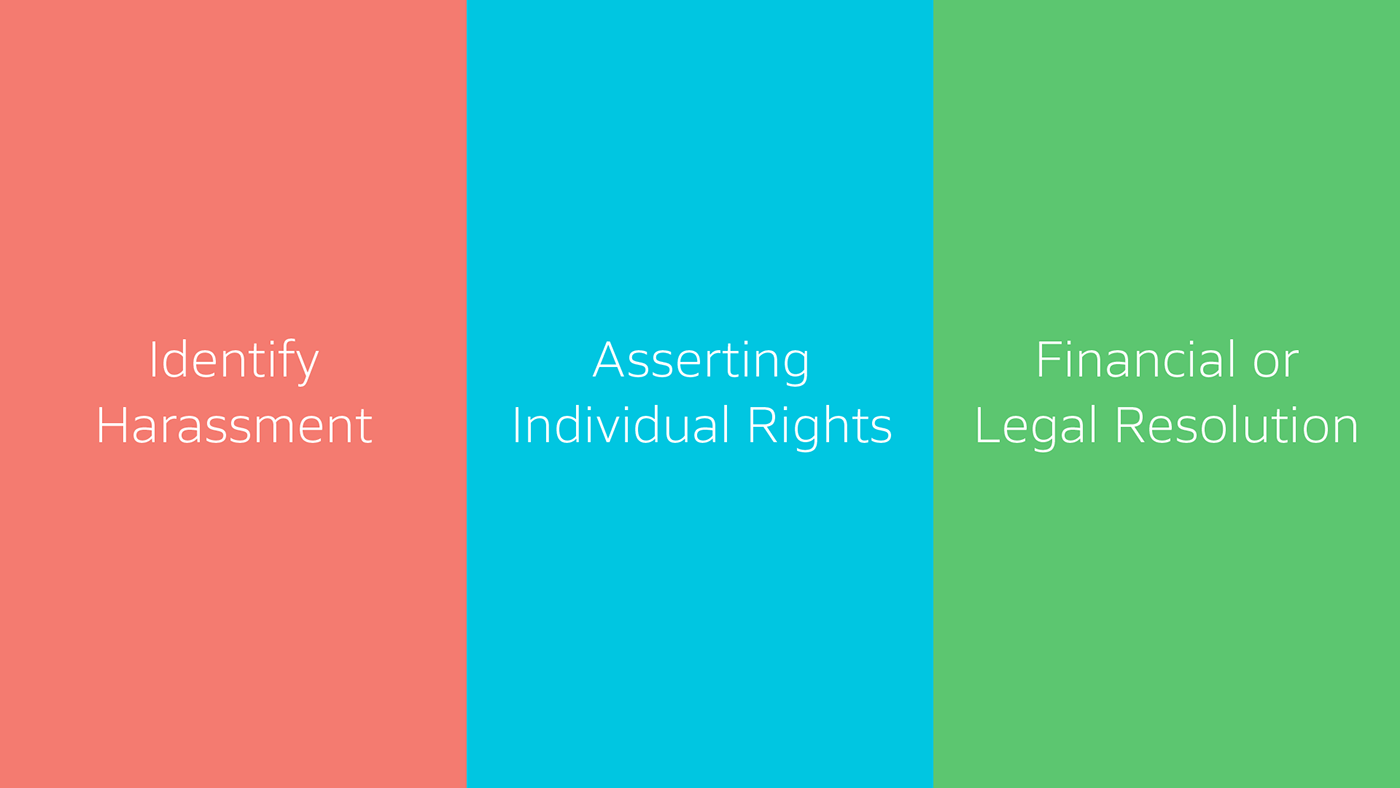

Based on how the debt collection agency responds to the letter, we can provide actionable insight to help people resolve their debt. Whether that means negotiation, filing for bankruptcy, or taking legal action against the debt collection agency.

In the future, we will automate the entire process, from identifying debt collection agency harassment, to asserting individual rights against the agency, to recommending the appropriate financial or legal solution to finally resolve someone’s debt.

We believe this tool can amplify the work of financial counseling and legal service providers, by working with them and making them more efficient and reaching more people in need.

Thank you! We're DaisyDebt, a debt solutions organization. Please say hello!